Best Location in UK for Buy to Let? The UK property market offers a wealth of opportunities for savvy investors. Buy-to-let (BTL) investments, in particular, have gained significant popularity over the last few years, but is it still viable in 2024?

The success of a BTL investment largely depends on the chosen location. In this comprehensive guide, Nexus Investor, will guide you through the best places in the UK for BTL investments. We will provide you with valuable insights, landlord tips, and strategies to help you grow your property portfolio effectively in 2024.

Understanding Buy-to-Let Investments in the UK

Buy-to-let (BTL) investments involve purchasing a property with the intention of renting it out. In the UK, this investment strategy has become increasingly popular and many investors are attracted to the potential for steady rental income and long term capital growth.

However, BTL investments are not without their challenges, especially in the current environment of high interest rates and strong governmental regulation. Understanding the dynamics of the property market and the factors influencing rental demand is crucial for success and this knowledge can help investors make informed decisions and maximise their returns.

The Significance of Location in BTL Investments

The location of a property plays a pivotal role in its investment potential, which can significantly influence the rental yield, tenant demand, and capital appreciation. For instance, properties in areas with strong employment opportunities or good schools often attract high tenant demand.

Similarly, areas undergoing infrastructure development or regeneration can offer promising capital growth prospects. Therefore, thorough research into the local property market is a key step in selecting a profitable BTL investment.

Analysing the UK Property Market Trends

Keeping abreast of the latest trends in the UK property market is essential for BTL investors. These trends can provide insights into potential investment hotspots and future market directions. For example, the shift towards remote working has increased the appeal of properties in suburban or rural areas.

On the other hand, government policies, such as the introduction of Tax credits on mortgage interest, which came into full effect from April 2020. It meant that landlords could no longer deduct any of their mortgage interest from their rental income when calculating their taxable profit. Instead, landlords receive a 20% tax relief on mortgage interest payments. This caused many more landlords to be pushed into the higher 40% of taxation, and had an impact on their profitability. In addition to this, economic factors, such as high interest rates, have also greatly impacted the property market. Understanding these trends can help investors anticipate changes and adapt their investment strategies accordingly.

Key Factors for Selecting the Best BTL Locations

When choosing a location for a BTL investment, several factors come into play, which can significantly influence the profitability of the investment. They include rental yield, tenant demand, capital growth prospects, and economic and infrastructure developments.

Investors should consider these factors in conjunction with their investment goals and risk tolerance. Some investors may prioritise high rental yields, while others may focus on the long term capital growth, which we have consistently seen for many years.

Key takeaways to consider:

- Rental yield

- Tenant demand

- Capital growth prospects

- Economic and infrastructure developments

Rental Yield and Tenant Demand: Best Location in UK for Buy to Let

Rental yield is a key indicator of a property’s potential return, and can be calculated by dividing the annual rental income by the property’s purchase price. High rental yields can provide a steady income stream for investors, and can offer security from interest rate rises, to ensure the investment is still profitable. According to data from Zoopla, rents rose by 9.7% in 2023 and this growth is forecasted to continue at 5% in 2024.

Tenant demand, on the other hand, can influence the occupancy rate and rental price. Properties in areas with high tenant demand are less likely to have prolonged void periods. Therefore, understanding the local rental market and tenant preferences is crucial for maximising rental yield and tenant demand. A good resource to research these trends is on home.co.uk, where you can look at current market rents in regions over the UK and sale prices, for all different types and sizes of properties.

University Proximity: The UK regions with significant student populations often offer high investment yields. University hubs such as Manchester, Sheffield, Liverpool, Middlesbrough, and Newcastle are considered lucrative for buy-to-let properties. The constant influx of students ensures that landlords can plan their tenancies around academic schedules, maintaining full occupancy.

Local Amenities and Schools: Although students are reliable for continuous rental income, they might not always maintain properties as meticulously as landlords would prefer. For investors concerned about property maintenance, targeting young professionals and families might be beneficial. These groups usually prioritise nearby amenities, including good schools, convenient shopping, and transport links.

City Access and Commuter Friendliness: For all renters, whether students, families, or professionals, the ease of commuting to work or school is crucial. Those living in city centres may pay higher rents for the convenience of shorter commutes. However, for properties on the outskirts, ensuring that potential tenants are not deterred by longer commute times is essential for attracting and retaining tenants. However, with the more recent work from home environment, this is becoming less of an issue.

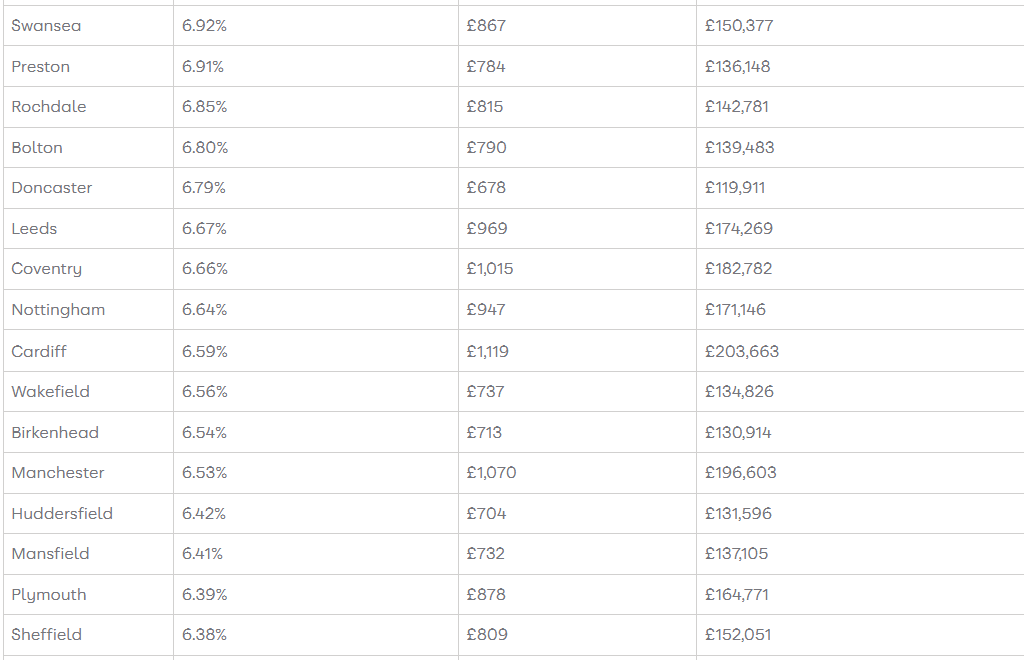

Best Location in UK for Buy to Let: Top 16 Rental Yields in 2024

Best Location in UK for Buy to Let: Best of the rest Rental Yields in 2024

Source: Zoopla

Capital Growth Prospects

Capital growth refers to the increase in a property’s value over time and can provide a significant return on investment when the property is sold. Conducting research on Rightmove can provide essential information about previously sold house prices in an area, as a way of comparing to how prices in that region have changed over time. Factors influencing capital growth include local property market trends, economic conditions, and infrastructure developments.

Areas with strong economic growth or planned infrastructure projects often have high capital growth potential. Therefore, investors should consider the long term growth prospects of a location when selecting a BTL investment. The list below are the changes in capital growth over the last year.

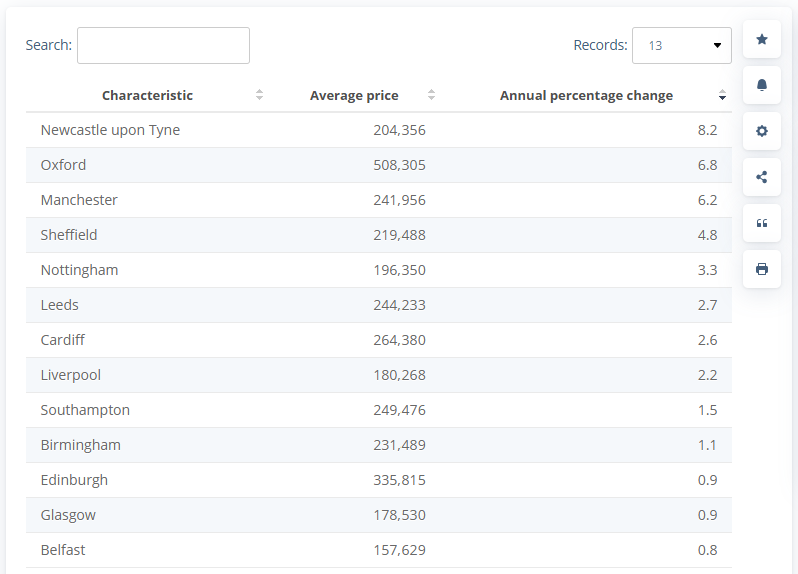

Best Location in UK for Buy to Let: Capital Growth 2023-2024

Source: Statista

Economic and Infrastructure Developments

Economic and infrastructure developments can significantly impact a property’s investment potential. Areas with strong job growth or major infrastructure projects often attract more tenants, which can lead to increased rental demand and property values. In London, the introduction of the Elizabeth line connecting the east of the city to the west is a prime example of this. Area’s to the east of Stratford, such as Romford, Ilford and Shenfield have seen strong capital growth as it is now much quicker and easier to get into Central London.

On the other hand, economic downturns or lack of infrastructure can negatively affect property prices and rental demand, so keeping an eye on local economic trends and planned developments is essential for BTL investors.

Best Location in UK for Buy to Let: Top UK Cities for Buy-to-Let Investments

The UK offers a diverse range of cities for BTL investments each with it’s unique characteristics, opportunities, and challenges. From high rental yields to strong capital growth prospects, these cities offer attractive investment opportunities. However, it’s crucial to conduct thorough research and due diligence before investing. The list below are some of the city’s that ourselves at Nexus Investor, highly favour for their mix of high yield, tenant demand and strong capital growth prospects over the coming years. They are all strong university cities, and have a strong attraction for professionals.

Best Location in UK for Buy to Let: Let’s explore some of the top UK cities for BTL investments (in no particular order):

City 1: Best Location in UK for Buy to Let: Liverpool

Liverpool is acclaimed as one of the best places to invest in the UK due to its dynamic market and cultural vibrancy. It is projected to experience a rental growth of 15.9% over the next four years. The city is undergoing extensive regeneration, with projects valued at over £5 billion. Liverpool is also a popular destination for over 70,000 students, enhancing its appeal as a vibrant, youthful city. The city has experienced a rise in average property prices from £108,000 in 2011 to £166,000 in 2021.

Recognised globally alongside Birmingham and Manchester, Liverpool is a thriving hub for business start-ups. Additionally, its world-renowned cultural hotspots and amenities enrich the living experience for residents, making it an attractive option for investors. Liverpool offers high rental yields, strong tenant demand, and affordable property prices.

City 2: Best Location in UK for Buy to Let: Manchester

Manchester is another attractive city for BTL investments. Manchester is hailed as one of the best places for property investment in the UK, thanks to its vibrant educational environment and economic strength. Approximately 46% of graduates opt to remain in the city after completing their studies, underlining Manchester’s exceptional ability to retain graduates.

The city is home to over 100,000 students, contributing to its youthful vibe, with an average age of just 33. As one of the largest regional economies outside of London, Manchester showcases robust economic vitality. The city has experienced a rise in average property prices from £123,000 in 2011 to £210,000 in 2021. From 2023 to 2027, it is expected to experience the most impressive rental growth in the country, positioning it as a prime location for buy-to-let investments.

City 3: Best Location in UK for Buy to Let: Leeds

Leeds offers a robust rental market and strong capital growth potential. We recognise Leeds as one of the best places to invest in the UK, largely due to its strong educational and employment sectors. The city boasts a large student population exceeding 65,000. Over the past two decades, Leeds’ population has grown at a rate seven times that of London, with an increase of over 150%. This rapid growth has resulted in demand significantly outpacing supply, especially as employment within the city has risen by 34%.

The city has experienced a rise in average property prices from £140,000 in 2011 to £211,000 in 2021 and property prices are expected to grow by 14.2% by 2027. Currently, 73% of households in Leeds are renters, highlighting the city’s strong rental market. Its thriving economy and planned infrastructure projects make it a promising BTL investment location.

City 4: Best Location in UK for Buy to Let: Birmingham

Birmingham is a major economic hub with very high tenant demand. We consider Birmingham one of the best places to invest in the UK due to its strong professional and educational appeal. It hosts the UK’s largest professional hub outside of London, with over 100,000 workers, and is ranked as the third best UK city for attracting graduates who have no prior ties to the area. The city’s youthful demographic is notable, with 40% of its population under the age of 25, creating a significant demand for rental properties. Birmingham is continuously improving its regional Metro links, enhancing connectivity between the city centre and surrounding communities.

Additionally, the city is a central point in the upcoming HS2 network, which will reduce travel time to London to just 49 minutes. These infrastructure improvements have led to a rise in average property prices from £132,000 in 2011 to £209,000 in 2021. Furthermore, Birmingham’s ambitious ‘Our Future City’ plan aims to rejuvenate the city centre and develop green connections throughout the region until 2040. Its ongoing regeneration projects and strong economy make it a viable option for BTL investments.

City 5: Best Location in UK for Buy to Let: Sheffield

Sheffield offers affordable property prices and high rental yields. Sheffield stands out as one of the top UK cities for investment, highlighted by several promising developments. The ‘Heart of the City’ project is transforming the urban landscape by creating impressive new public spaces. Sheffield is also an educational hub, home to two universities with a diverse student population of 63,000.

The city is poised for significant economic expansion, with an expected 70,000 new jobs over the next decade, largely due to the development of the Advanced Manufacturing Park. Additionally, £480 million has been invested in enhancing Sheffield’s retail and leisure sectors. In terms of capital growth, Sheffield has experienced a rise in average property prices from £126,000 in 2011 to £186,000 in 2021. Rental yields in Sheffield are particularly attractive, currently reaching up to 7.6%, which is an increase from last year’s 7%. Its growing economy and high student population make Sheffield an attractive location for BTL investments.

City 6: Best Location in UK for Buy to Let: Nottingham

Nottingham stands out as an excellent investment destination in the UK, thanks to its robust employment and regeneration initiatives. Approximately 70% of the city’s population is of working age and employed by local businesses. Significant regeneration projects, such as Broadmarsh and The Island Quarter, are expected to boost tenant demand further. The city has experienced a rise in average property prices from £103,000 in 2011 to £172,000 in 2021.

Nottingham also offers market leading rental yields, currently over 8.1% in the city centre. The presence of two city centre universities supports a large student population, enhancing the city’s dynamic atmosphere. Additionally, Nottingham is home to the Queen’s Medical Centre, a major ‘super-hospital’ that contributes 6,000 jobs to the local economy.

City 7: Best Location in UK for Buy to Let: Newcastle

Newcastle is recognised as one of the best places to invest in the UK, offering compelling reasons for investors. Notably, postcodes such as NE1 and NE8 are delivering investment yields of over 7%. The city is home to a market-leading start-up incubator that fosters new business development and attracts young professionals.

This entrepreneurial environment is complemented by the presence of headquarters for large national brands, further driving demand in the local property market. In terms of capital growth, Newcastle has experienced a rise in average property prices from £137,000 in 2011 to £179,000 in 2021. Newcastle also boasts a substantial student population of over 50,000, adding to its vibrant community. Additionally, it serves as a cultural leader for the wider North-East region, enhancing its appeal as a place to live and invest.

Landlord Tips for Managing a Successful Property Portfolio

Managing a successful property portfolio requires strategic planning and effective management. It is not just about acquiring properties, but also about managing them efficiently.

Here are some tips for landlords to manage a successful property portfolio:

- Understand your market and tenant demographics

- Maintain positive tenant relationships

- Regularly review and adjust your investment strategy

- Stay informed about market changes and investment opportunities

- Consider diversifying your portfolio across different regions and property types

Property Management and Tenant Relations

Effective property management is crucial for BTL investments. It involves maintaining the property, managing tenants, and ensuring a steady rental income. Building positive tenant relationships can lead to longer tenancies and lower void periods.

Legal Responsibilities and Risk Mitigation

Landlords have legal responsibilities that they must adhere to. These include ensuring the property is safe and habitable, and complying with all relevant laws and regulations. Risk mitigation strategies, such as insurance and regular property maintenance, can help protect your investment.

The Future of Buy-to-Let Investments in the UK: Best Location in UK for Buy to Let

The future of buy-to-let investments in the UK looks promising and despite challenges, the demand for rental properties remains high. The UK property market is resilient and has shown strong recovery trends after economic downturns. Emerging trends and market changes will certainly shape the future of BTL investments, but investors who adapt to these changes can continue to reap significant benefits.

Predictions and Emerging Trends and Adapting to Market Changes

Experts predict steady growth in the overall UK property market. Emerging trends include the rise of technology in property management and the growing importance of sustainability. Investors are also exploring niche markets, such as luxury rentals and holiday lets/air bnb and more advanced strategies such as HMO investments, Rent 2 Rent and lease options to boost profitability. Adapting to market changes is crucial for investment success and investors need to stay informed, be flexible, and adjust their strategies as needed.

Conclusion

In conclusion, the UK’s property market remains a fertile ground for buy-to-let investments in 2024, despite some challenges. As our guide from Nexus Investor outlines, location is paramount in maximising the potential of these investments. By focusing on areas with strong economic indicators, such as employment rates and student populations, and considering the impact of infrastructural developments, investors can strategically position themselves for success.

Each featured city: Liverpool, Manchester, Leeds, Birmingham, Sheffield, Nottingham, and Newcastle offers unique opportunities based on their economic resilience, tenant demand, and potential for capital growth. As we navigate through the evolving landscape of the UK property market, informed decision making and strategic planning will be key to achieving sustainable returns and growing a robust property portfolio.

Recommended software for Landlords to keep track of their Property Portfolio Business from: Property Portfolio Software

Recommended Educational courses and Property Networking for Landlords to enhance their knowledge and build property business relationships: Property Investor Network (PIN)