Global Market Blood Bath

At the time of writing:

Nikkei 225 Index: 34,675.46

S&P 500 Index: 5,186.33

NASDAQ: 16,200.08

Dow Jones Industrial Average: 38,703.27

FTSE 100: 8,007.08

CBOE Volatility Index: 31.70

Bitcoin/USD: 55,290.00

On 5th August 2024, the financial world was gripped by a series of tumultuous events as global markets tumbled in response to Japan’s unexpected decision to raise interest rates from sub zero levels to 0.25% last week. This significant policy shift sent shockwaves across various investment sectors, from stock markets to cryptocurrencies, marking a day of considerable losses and frantic trading activities.

In response, the team at Nexus Investor, has conducted a thorough analysis of these market movements. Now that the initial chaos has subsided, we are poised to offer an in depth examination of the day’s events, authored by our expert financial analysts. Our analysis aims to provide clarity and insight into the complex dynamics that fuelled this financial turmoil.

This article will delve into the motivations behind Japan’s rate hike, the complexities of the yen carry trade, and the subsequent global market reactions. We aim to unpack these interconnected elements to present a narrative that not only informs but also aids investors in understanding the broader implications of such significant economic shifts. Join us as we explore the intricate web of factors that led to a day no investor could ignore, one if not the worst since the Covid crash in March 2020.

Background and Context: Global Market Blood Bath

Before the financial shockwave on 5th August 2024, global markets had been navigating through a relatively stable period, bolstered by robust economic indicators and investor optimism. However, underlying this view point of relative stability were complex financial instruments and international monetary policies that posed potential risks.

Historical Context of Japan’s Monetary Policy

For decades, Japan has grappled with economic stagnation and deflationary pressures, leading to the adoption of ultra loose monetary policies and introducing quantitive easing. Interest rates in Japan have hovered around zero or even dipped into negative territory as part of the country’s aggressive approach to stimulate economic growth. These policies made the Japanese yen a popular choice for the carry trade.

The Yen Carry Trade Explained

The yen carry trade has been a significant financial strategy where investors borrow Japanese yen at low interest rates to invest in higher yielding assets in other currencies. This trade not only provided lucrative returns given the disparity in global interest rates but also influenced currency and asset prices worldwide. The attractiveness of such trades lies in the potential for high returns, provided the yen remains weak against other currencies.

Economic Stability Prior to the Crash

Global markets had been benefiting from a prolonged period of economic growth, which saw equity markets hitting record highs and investment in cryptocurrencies expanding rapidly. Investors had been maximising returns through various strategies, including the carry trade, which contributed to an interconnected global financial system. However, this system also meant that shifts in one part of the world could have disproportionate effects elsewhere, setting the stage for potential volatility.

Signs of Change and Emerging Risks:

Though the markets were buoyant, there were emerging signs that the environment was shifting. Economists and financial analysts had been noting several indicators suggesting that the global economic environment was becoming increasingly susceptible to shocks. These included tightening monetary policies in various countries, geopolitical tensions, and significant fluctuations in commodity prices, all of which contributed to a growing sense of unease among investors.

The Catalyst: Japan’s Interest Rate Hike

The sudden announcement by the Bank of Japan to increase interest rates to 0.25% came as a shock to global financial markets and Japan’s decision was influenced by several factors. Primarily, it was an attempt to normalize monetary policy after years of ultra loose settings, which included extensive quantitative easing and negative interest rates. The Japanese economy had shown signs of recovery, with slight inflationary pressures emerging, warranting a cautious approach towards tightening.

The increase in interest rates, albeit modest, was enough to unsettle this arrangement. As the rates rose, the cost of borrowing yen increased, diminishing the attractiveness of the carry trade. Investors began to unwind these positions, leading to significant capital flows that impacted currency values and asset prices globally.

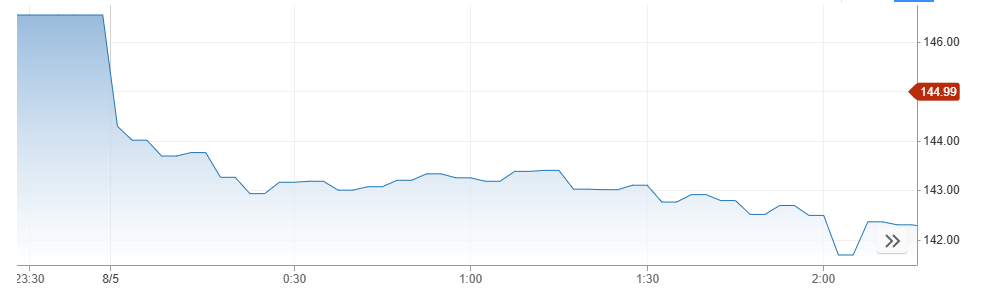

This hike in interest rates caused the Nikkei index to plummet, reflecting investor panic and the sudden shift in economic expectations. As the yen strengthened against other currencies, especially the USD, as in the above USD/JPY chart, international investors rushed to adjust their portfolios, leading to widespread sell offs. The impact was not confined to equities; bond markets, commodities and cryptocurrencies also experienced volatility as the traditional dynamics of the carry trade were disrupted.

The rate hike also had unintended consequences for financial institutions and hedge funds engaged in complex financial derivatives tied to the yen. Many of these positions assumed continued low rates, and the sudden increase triggered a series of margin calls and liquidity demands, exacerbating the market’s downward spiral.

Immediate Market Reactions

Global Stock Market Response: The week started with sharp declines across global markets, intensified by worries over a potential US recession and the end of the US tech boom. These concerns, coupled with the sudden appreciation of the Japanese yen, led to widespread selling. The US job market data released the previous Friday had already initiated a downturn, which escalated as markets opened in Asia. Japan’s Nikkei index recorded its most significant drop since 1987, plummeting 12% in just one session to a low of 31,485 and it was trading at over 42,000 just last month, though it recouped most of these losses by Tuesday.

In the US, major indices such as the S&P 500 and Nasdaq Composite closed down by about 3%. Similar trends were observed in Europe with the FTSE 100 and the Stoxx 600 each falling by 2%. The volatility, measured by indicators like the VIX, soared to levels reminiscent of the 2020 pandemic crisis, and not a great deal lower than the VIX spike during the financial crisis in 2008.

Cryptocurrency Markets: The cryptocurrency market was experiencing its own turmoil. Bitcoin’s market dominance spiked, reaching a yearly high of 58.1%, reflecting its relative resilience compared to other cryptocurrencies during market downturns. This shift occurred during a rapid sell-off that saw Ether drop by 18% within two hours, while Bitcoin itself fell by 10% in the same timeframe, down to around $49,000.

This significant movement in Bitcoin dominance was partly due to broader market fears, including recession concerns and geopolitical tensions, such as military escalations in the Middle East. Sectors that had performed well earlier in the year, including tech stocks, Bitcoin, and Japanese equities, were the hardest hit during this sell off.

Ether and other altcoins were particularly affected, with major tokens built on the Ethereum network seeing substantial declines. For instance, in the last seven days from the event, Ether’s price dropped by 30%, while other significant altcoins like Solana, BNB, and XRP saw declines of 35%, 25%, and 21%, respectively.

This detailed account of the immediate market reactions to Japan’s rate hike provides insight into the fragile interconnectedness of global financial markets and the swift shifts that can occur in response to policy changes and global events.

Please feel free to take a look at our article on Bitcoin Dominance, to gain a greater understanding of its implications.

Try not to Panic during these volatile times

Currency dynamics have played a crucial role in the recent market turmoil, influenced by disparities between US and Japanese interest rates. The US has maintained high interest rates (5.25% – 5.50%), The UK have just cut their interest rates to 5%, down from 5.25% last week, while Japan has kept theirs low, recently raising them to 0.25%. This differential has fuelled the carry trade, however, a slump in the dollar due to fears about the US economy prompted a revaluation of these trades, leading to significant currency shifts and market reactions.

Key Market Movements and Decisions:

- The sudden drop of the dollar from JPY 160 to JPY 140 has forced traders to rapidly close their derivative positions, contributing to the panic and volatility in the markets.

- Tech stocks like Nvidia, which have seen significant gains (up 2500% over five years), experienced a drop (6% on Monday), suggesting a market correction but also potential future opportunities as the market stabilises.

- Japanese equities, despite recent corrections, may still hold value, especially for domestically focused companies that could benefit from a stronger yen.

Strategic Insights for Investors:

Here at Nexus Investor, we recommend sticking to your investment objectives. It can even be seen as a buying opportunity to pick up some assets at lower prices. Past shocks such as the 2020 pandemic sell off, which even though were severe, they were quickly short lived, and in a few weeks or months, it may be looked back on as a great time to have bought.

We’re nearing a phase in the investment cycle where we can expect significant gains, particularly in cryptocurrencies. It’s crucial to remain composed and avoid allowing fear or panic to jeopardise your investment positions. Investors are encouraged to stay informed and possibly capitalise on adjustments during market corrections rather than hastily divesting their assets, but it is key to do your own research.

Navigating current market conditions requires a balanced approach, taking into account both the immediate impacts of currency fluctuations and the broader economic indicators. For those looking to understand deeper or potentially adjust their investment strategies, keeping an eye on central banks’ actions (like rate adjustments by the Federal Reserve and the Bank of Japan or Bank of England) and market analysts’ forecasts can provide critical guidance.

For more insights on market strategies during uncertainty, check out our continued articles by Nexus Investor, where we can offer further detailed guidance and commentary.

Disclaimer:

The information provided by Nexus Investor is for general informational purposes only. All information on the site is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the site. Under no circumstance shall we have any liability to you for any loss or damage of any kind incurred as a result of the use of the site or reliance on any information provided on the site. Your use of the site and your reliance on any information on the site is solely at your own risk.

This site is not intended to provide, and should not be relied on for, financial, legal, tax or accounting advice. You should consult your own financial, legal, tax, or accounting advisors before engaging in any transaction.