In the latest rollercoaster ride of the crypto realm, Bitcoin has taken a tumble, dragging the altcoins further down with it. Picture this: Bitcoin, Ether, and friends all deciding to take a collective nosedive, as if they were synchronized swimmers, but without the grace and poise.

The culprit? Well, it seems the financial markets are weakening, with concerns of interest rates staying higher for longer due to less favourable Inflation data.

Bitcoin Dips

Bitcoin, the big dog in the yard, is down approximately 6.3% in the last 24 hours, slipping below that important $60,000 phycological support. And what’s worse, it’s not alone in this downward spiral. The wider crypto market, measured by the CoinDesk 20 Index (CD20), decided to join the party, shedding nearly 9% before remembering they left the stove on at home.

So, what’s causing this cryptocurrency calamity? Well, it seems the broader financial markets are in a mood, giving off serious ‘risk-off’ vibes with echoes of slower growth and sticky inflation in the US, Europe and the UK, it seems everyone’s feeling a bit under the weather.

But wait, there’s more! Ether, the Robin to Bitcoin’s Batman, slipped about 5%, diving below $3,000. Meanwhile, dogecoin, the leading meme coin of the crypto world, led the pack with a whopping 9% slide. It’s like watching a sitcom where the characters can’t catch a break. To add to the pain, other main layer 1 players Solana and Avalanche also both lost about 6%.

But amidst the chaos, there’s a beacon of hope, here at Nexus Investor we have a potential price target of $50,000-$55,000, for Bitcoin, which could provide a nice buying opportunity.

Bitcoin ETF

Recent outflows, and lack of purchasing from US spot exchange-traded funds have been seen as a catalyst to the current correction. Outflows of over $500 million have occurred since the Bitcoin halving on April 20, at which time the price of Bitcoin was at similar levels they are today on $57,863 at the time of writing. It seems as though the honeymoon period of the ETF hype might now be over.

So, what’s next for Bitcoin and its merry band of altcoins? Will they bounce back like a resilient rubber ball, or will they continue their downward descent? Only time will tell, but one thing’s for sure: the crypto rollercoaster never fails to keep us on our toes. Buckle up, it’s going to be a wild ride!

Here at Nexus Investor, we give our opinions on the market based on the research we have conducted and current trends in the market. We are not providing investment advice for you to directly act upon. Cryptocurrencies are highly volatile; please ensure you do your own research and due diligence before investing any of your own money.

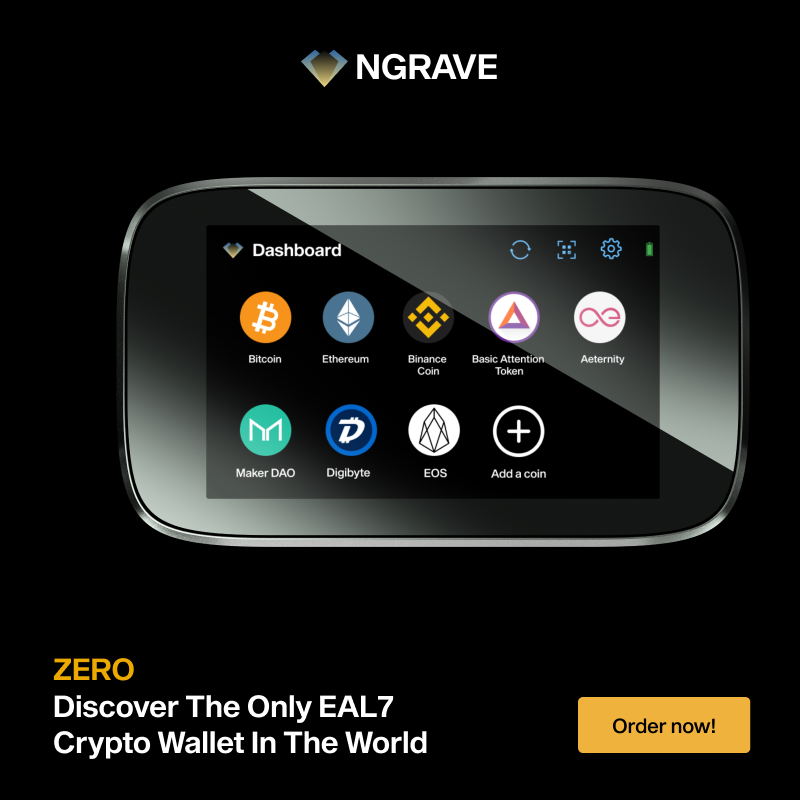

Ngrave is a relative newcomer to the crypto storage scene. Despite its recent entry, it has made bold claims about its security, touting itself as the “world’s most secure” wallet. Ngrave operates completely air gapped, meaning it doesn’t require a USB or Bluetooth connection. This feature significantly reduces the risk of hacking.

The wallet has also achieved an EAL7 security certification, the highest level possible. However, its premium price and newness on the market may deter some users. Despite these potential drawbacks, Ngrave’s commitment to security is commendable. It’s a wallet to watch as it continues to establish itself in the market.

Please check out our comprehensive Cryptocurrency Cold Wallet review here.

In the world of cryptocurrencies, security is paramount. One of the most secure ways to store your digital assets is through crypto cold wallets. These storage wallets, like BC Vault, Ledger, Trezor, Ngrave, and Ellipal, offer a secure way to store your cryptocurrencies offline. the team at Nexus Investor will delve into a detailed comparison of these top cold storage wallets.