Non Dom Tax Status UK is essential to understand for anyone looking to optimise their tax liabilities while residing in the country. While the term might sound like something out of a spy novel, it’s actually about where you’re considered “officially” at home for tax purposes. Traditionally offering significant tax benefits, recent changes and upcoming reforms mean that navigating this landscape requires careful planning and staying informed.

Understanding Non-Dom Tax Status UK is essential for investors to optimise their tax liabilities. Non-dom status allows investors to pay UK tax only on income and gains remitted to the UK, rather than worldwide income. This offers significant tax efficiency and benefits in wealth and estate planning. Staying informed about non-dom rules is crucial for compliance and adapting to legislative changes.

In this guide, Nexus Investor will be joined by a guest appearance from Gunit Puri (FCCA, CertITM, BA Economics), who is a top Finance Director. He has worked in finance and accounting for nearly 20 years in London and more recently Dubai, and has a wealth of experience. The team at Nexus Investor is delighted to have a real expert in the industry assist a crucial role in this article.

We will provide you an overview of what non-dom status entails, the recent legislative changes, and what these mean for non-doms living in the UK. Whether you’re new to the concept or looking to stay compliant amidst evolving regulations, this article is your go to resource for managing Non-Dom Tax Status in the UK effectively.

Table of Contents

What is Non-Dom Status?

Non-dom stands for non-domiciled (Not your permanent home), the definition of non-dom is defined as being:

‘UK resident whose permanent home – or domicile – for tax purposes is outside the UK.’

It’s important to remember that this is just referring to a person’s tax status and has nothing to do with their nationality, although factors such as citizen or resident status can ultimately effect this.

A non-dom only pays tax on the money they earn inside of the UK, they therefore do not pay UK tax on earnings in other countries around the world.

The only exception to this is if they pay money from overseas into a UK bank account. This situation is known as the remittance basis.

A great way to save tax therefore, is by choosing your domiciliate based on a country with a lower tax regime, however since 2017 and at the start of 2024 the non-dom basis has been scrutinised and what was once a tax efficient regime for high net worth individuals will no longer be a way to save tax in the coming years.

Defining Domicile

There are 2 ways to choosing where you domicile:

- Domicile of Origin – where you were born or your fathers place of birth.

- Domicile of Choice – when you are over 16 and you make the decision to live indefinitely in another country.

Non Dom Tax Status UK: Most Recent Changes

During the spring budget in March 2024, the then chancellor, Jeremy Hunt, said non-dom status would be phased out in the coming years.

The basis of this was that people moving to the UK will not therefore have to pay tax on their worldwide income for the first 4 years after moving. After that (year 5) they will start paying the same tax as everyone else on all their earnings be that inside or outside the UK.

The hard facts behind doing this is that it will recoup for the chancellor around £2.7bn a year by 2028/29.

Back in March, with the general election scheduled for the 4th July 2024, when Labour were looking likely to win, its worth looking back at their manifesto to see how they intended to deal with the non-dom taxation conundrum. As we now know, Labour convincingly won the general election and are now in government so it is important to see what they had planned to be put in place regarding this complex topic.

Labour have gone a step further to state they would close the tax shortfall further by doing the following:

- Remove the 50% discount in the first year (Originally part of the Tories Spring budget).

- Include foreign assets that are held in a trust in the UK within the UK inheritance tax network.

- The above changes would raise a further £2.6bn over the next government’s cycle.

So, for those who are Non-Dom but living in the UK and not paying UK tax on their overseas earnings the following applies:

Payment of £30k if you have been living in the UK for 7 of the past 9 years

Payment of £60k if you have been living in the UK for 12 of the past 14 years

In 2017 the rules changed to no longer allow people to claim non-dom status if they were resident in the UK for 15 of the past 20 years.

Along with this came the rule that you could not claim non-dom, while living in the UK if the following was true:

-You were born in the UK

-Your domicile of origin was the UK

-You were resident for at least 1 year in the UK since 2017.

Changing your Domicile is an important part of this and the government have been clear that the burden of proof is on the person leaving the UK to show that they are moving permanently away from and what clear steps they have taken.

Can you have Dual Residence?

It is possible for you to be UK resident under UK tax rules and at the same time be resident in another country under that country’s rules. This is sometimes referred to as ‘dual residence’. If you’re UK resident and resident in another country, and the UK has a Double Tax Arrangement (DTA) with the other country, there may be provisions that determine where you will pay tax. An example of this is the Double Tax Agreement between the UK and UAE, where in recent years there have been a large number of UK residents seeking opportunities and tax advantages by moving to work in Dubai.

Non-resident Landlords

If you will have rental income from property in the UK, this income will be liable to UK tax whether or not you’re resident in the UK. If you sell or dispose of a UK residential property you may have to pay Capital Gains Tax on the gains you make.

Am I UK resident for tax purposes?

From the tax year 2013 to 2014 onwards, you’re likely to be treated as UK resident under the Statutory Residence Test (SRT) if you:

- Spend 183 or more days in the UK in the tax year

- Have a home in the UK, and do not have a home overseas

- Work full-time in the UK over a period of 365 days

Statutory Residence Test (SRT)

The test allows you to work out your residence status for a tax year. Each tax year is looked at separately, so you may be resident in the UK in one year but not the next, or vice versa.

The SRT takes into account:

- The amount of time you spend and, where relevant, work in the UK

- The connections you have with the UK

It is split into the following parts:

- Automatic overseas tests

- Automatic UK tests

- Sufficient ties test

- Application of the SRT to deceased persons

- Split years

You’ll be resident in the UK for a tax year, and at all times if in that tax year:

- You do not meet any of the automatic overseas tests

- You meet one of the automatic UK tests or the sufficient ties test

Automatic Overseas Tests

First automatic overseas test

You’ll be non-UK resident for the tax year if you were resident in the UK for one or more of the 3 tax years before the current tax year, and you spend fewer than 16 days in the UK in the tax year.

Second automatic overseas test

You’ll be non-UK resident for the tax year if you were resident in the UK for none of the 3 tax years before the current tax year and spend fewer than 46 days in the UK in the tax year.

Third automatic overseas test

You’ll be non-UK resident for the tax year if you work full-time overseas over the tax year and:

- You spend fewer than 91 days in the UK in the tax year

- The number of days on which you work for more than 3 hours in the UK is less than 31

- There is no significant break from your overseas work

A significant break is when at least 31 days go by and not one of those days is a day where you:

- Work for more than 3 hours overseas

- Would have worked for more than 3 hours overseas, but you did not do so because you were on annual leave, sick leave or parenting leave

If you have a significant break from overseas work, you’ll not qualify for full-time work overseas.

The test:

- Can apply to both employees and the self-employed

- Does not apply to voluntary workers or workers with a job on board a vehicle, aircraft or ship

Automatic UK tests

First automatic UK test

You’ll be UK resident for the tax year if you spend 183 days or more in the UK in the tax year.

Second automatic UK test

You’ll be UK resident for the tax year if you have, or have had, a home in the UK for all or part of the year and the following all apply:

- There is or was at least one period of 91 consecutive days when you had a home in the UK

- At least 30 of these 91 days fall in the tax year when you have a home in the UK and you’ve been present in that home for at least 30 days at any time during the year

- At that time you had no overseas home, or if you had an overseas home, you were present in it for fewer than 30 days in the tax year

If you have more than one home in the UK you should consider each of those homes separately to see if you meet the test. You need only meet this test in relation to one of your UK homes.

Third automatic UK test

You’ll be UK resident for the tax year if all the following apply:

- You work full-time in the UK for any period of 365 days, which falls in the tax year

- More than 75% of the total number of days in the 365 day period when you do more than 3 hours work, are days when you do more than 3 hours work in the UK

- At least one day which has to be both in the 365 day period and the tax year is a day on which you do more than 3 hours work in the UK

Sufficient ties test

Use the sufficient ties test to work out your UK residence status for the tax year if you do not meet either any of the:

- Automatic overseas tests

- Automatic UK tests

You’ll need to consider your connections to the UK, known as ‘ties’, to work out if your ties, taken together with the number of days you spend in the UK, will make you resident in the UK for that particular tax year.

If you were not UK resident in any of the 3 tax years before the one you are considering, you’ll need to check if you have any of the following:

- A family tie

- An accommodation tie

- A work tie

- A 90 day tie

If you were resident in the UK in one or more of the 3 tax years before the one you are considering, you’ll also have to check whether you have a country tie.

Each of the ties has its own set of conditions or qualifying criteria attached to them. Read RDRM11500 onwards for full details.

The more UK ties you have, the fewer days you can spend here before you become UK resident.

Rules Summary and Key Takeaways

We understand these rules are quite complicated, the key takeaway is to understand that the Statuary Residence test (SRT) is the way the UK government determines tax status, namely, what country you need to pay tax to.

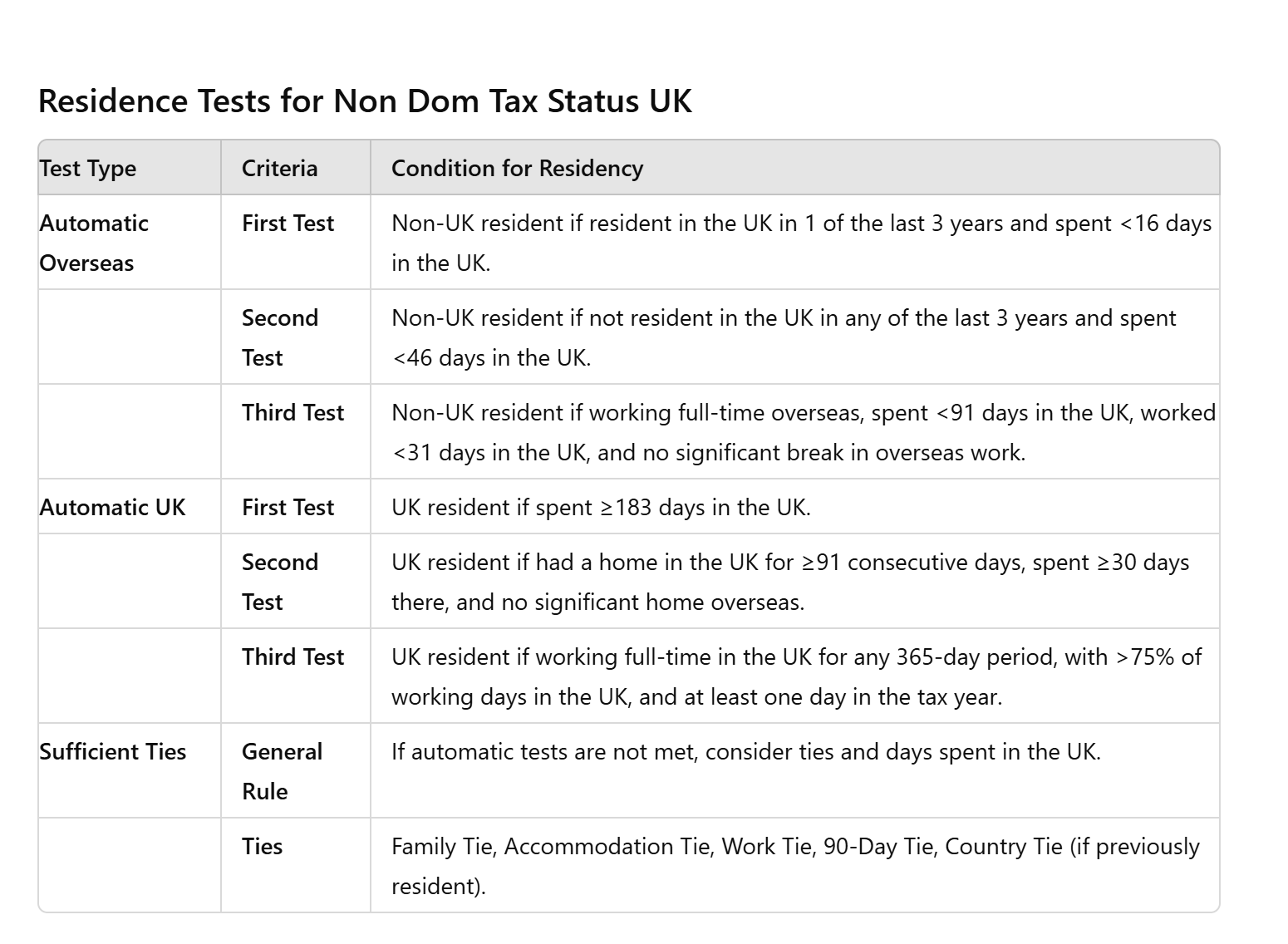

Summary of Residence Tests for Non Dom Tax Status UK

The table outlines the criteria used to determine whether you are considered a UK resident for tax purposes. Here’s the general idea:

- Automatic Overseas Tests: These tests determine if you are a non-UK resident. If you have been a UK resident in recent years, you must spend very few days in the UK to remain non-resident. Conversely, if you have not been a UK resident recently, you can spend slightly more days in the UK and still be considered non-resident.

- Automatic UK Tests: These tests establish if you are a UK resident. Spending a substantial amount of time in the UK, having a home in the UK, or working full-time in the UK makes you a resident.

- Sufficient Ties Test: If you don’t meet the automatic tests, this test looks at your connections to the UK (such as family, accommodation, work, and previous time spent in the UK). The more ties you have, the fewer days you can spend in the UK without becoming a resident.

In essence, the more significant your recent connection and time spent working in the UK, the fewer days you can be in the UK without being considered a resident, and vice versa.

SRT to Deceased Persons and Split Years

For completeness we will now explain the last parts of the rules as described above regarding STR for deceased persons and situations involving split years.

Application of the SRT to Deceased Persons

The first automatic overseas test cannot apply to a deceased person, but the other automatic overseas tests can apply.

There are 2 further automatic overseas test that only apply to deceased persons. They are the:

- Fourth automatic overseas test

- Fifth automatic overseas tests

Each has a set of conditions that must be met for that test to apply.

All the automatic UK tests can apply to a deceased person. There is also one further automatic UK test – the fourth test. This applies only to a deceased person. This test has its own set of conditions which must be met for that test to apply.

The UK ties test may need to be considered in respect of a deceased person. For a deceased person who has been resident for one or more of the previous 3 tax years, the number of days must be reduced proportionately.

For a deceased person who was not resident in any of the 3 previous tax years, the number of days also must be reduced proportionately.

Split years

You’ll be resident in the UK for the whole of a tax year, but that year may be split into a UK and an overseas part.

If, in a year in which you are UK resident, there is an actual or deemed departure from the UK, then you will need to consider whether any of the split year cases 1-3 apply.

If, in a year in which you are UK resident, there is an actual or deemed arrival in the UK then you will need to consider whether any of the split year cases 4-8 apply.

You must consider all cases of split year that might apply to you. Each has its own set of conditions, and you need to meet all those conditions for the case to apply. If more than one case applies to you the priority ordering rules show which case of split year will apply and what date the year will be split from.

How Rule Changes Affect the Number of Non-Dom Tax Payers

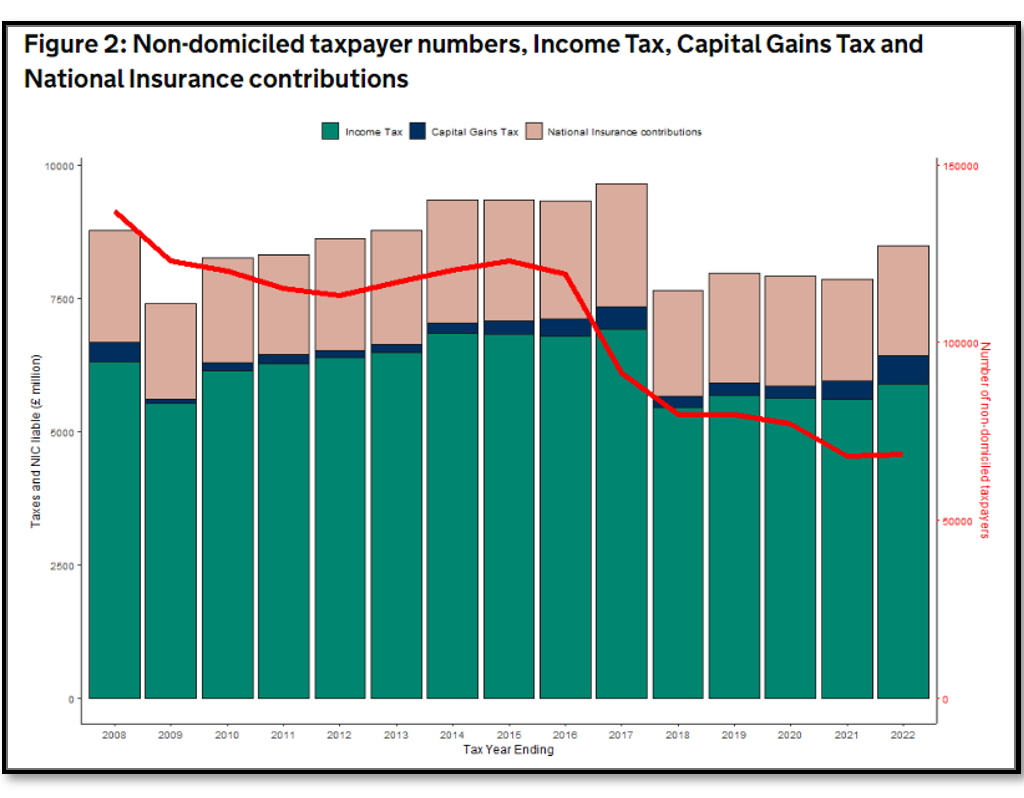

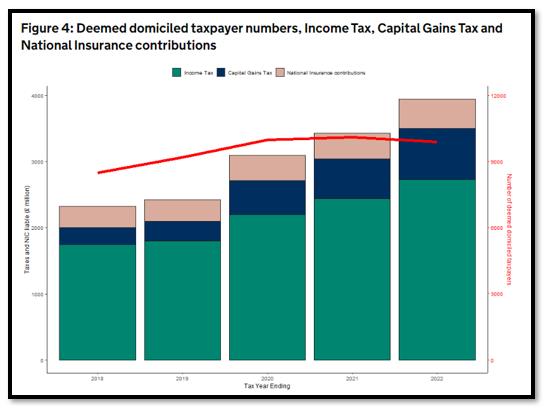

As we can see from the below graphs when new rules are introduced, where they have a negative impact on Non-Doms, we see a fall in the numbers, but they quickly seem to adjust to the new market conditions and then start to rise again.

Will we see a similar situation this time, if the new labour government impose new rules in 2024?

Note: Overall tax dropped after the 2017 non-dom rules were introduced

Note: from 2018 onwards we have started to see an increase in taxes….will this fall again with the impending 2024/25 changes

Conclusion

Navigating the complexities of non-dom Tax Status UK can be a daunting task, especially with the recent and upcoming changes in legislation. However, with careful planning and a clear understanding of your domicile options and obligations, you can manage your tax liabilities effectively.

Non-Dom rules provide crucial benefits for investors by enabling tax efficiency, strategic investment planning, and effective wealth management. By only paying UK tax on remitted income, investors can optimise their tax liabilities and preserve their wealth. Additionally, non-dom status offers advantages in inheritance tax planning, keeping foreign assets outside the UK inheritance tax scope.

Understanding these rules ensures regulatory compliance and avoids legal issues. With recent and upcoming changes, staying informed is vital for adapting strategies and maintaining tax advantages. Non-dom status is thus a key consideration for investors looking to maximise their investment returns and manage their financial affairs effectively within the UK tax framework.

We hope this comprehensive guide has provided you with valuable insights and practical advice to help you stay compliant and make informed decisions.

At Nexus Investor, we are committed to providing you with the most up to date information and expert advice. We extend our gratitude to Gunit Puri for his valuable contributions and expert insights in this article. Stay tuned for more expert guidance and tips from Nexus Investor to help you navigate the ever evolving tax landscape.